COR.CONNECT

Open Banking Solutions

Symcor is your key to unlocking the world of Open Banking through streamlined access to a secure network of data recipients and data providers.

Canada’s Trusted Data Network

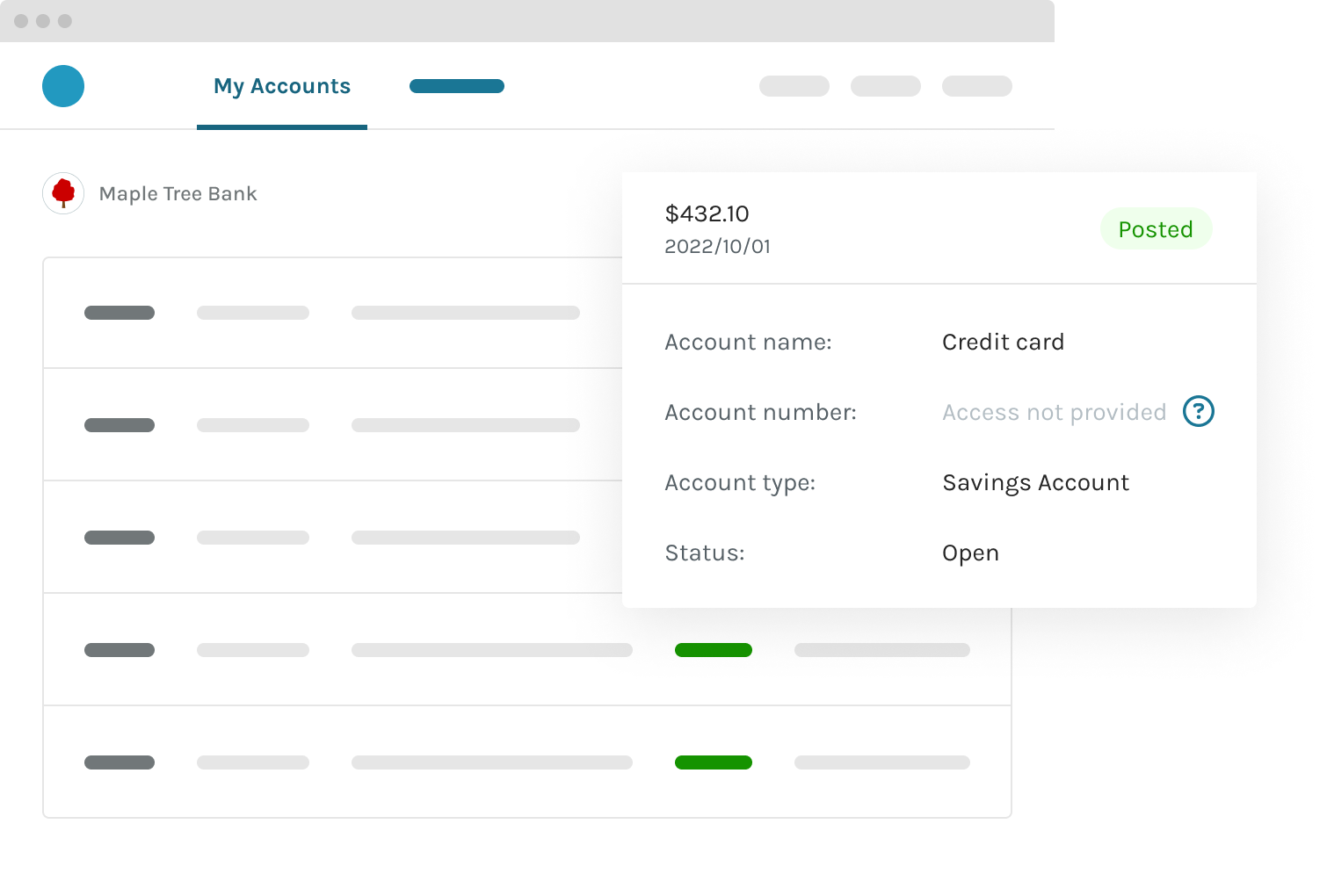

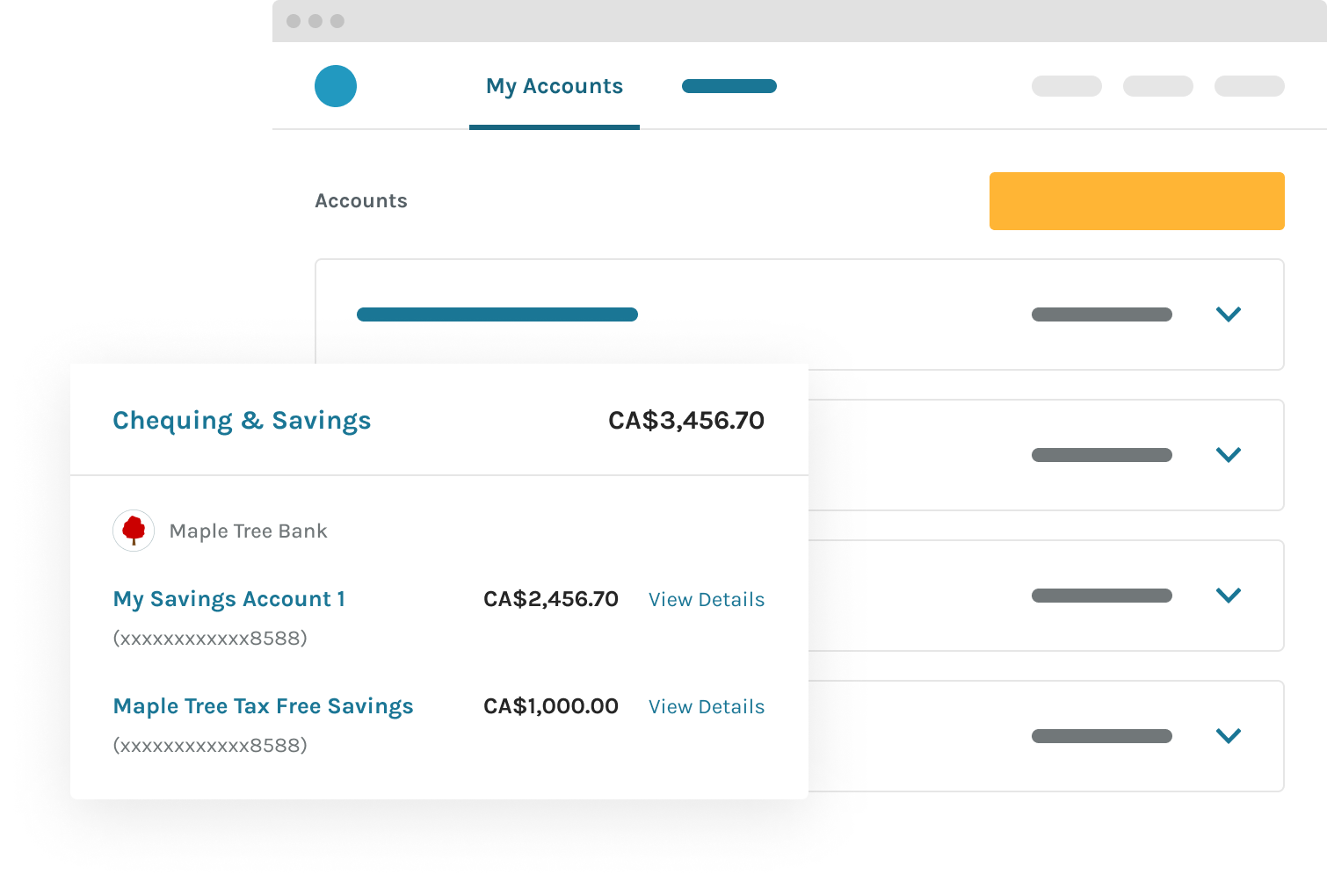

Symcor’s COR.CONNECT platform enables secure exchanges of user permissioned data, allowing consumers to be in control of their financial information.

Solutions for data recipients

COR.CONNECT Link

Power innovative use cases through streamlined access to Canada’s trusted data network:

- Wide Coverage – extensive data coverage and reach across financial institutions

- Reliable Performance – robust platform security, consistent service levels and standardized data

- Robust Data – actionable data insights

Benefits of COR.CONNECT Link

Real-time access to consented data through APIs

Simple API integration

Quick and easy onboarding

Robust test sandbox

Solutions for data providers

COR.CONNECT Hub

Safely share authorized data through Symcor’s interoperable Open Banking platform:

- Secure Network – FAPI advanced compliant data API enablement

- Authorization Management – white-labelled or provider hosted authorization and data provider managed authentication

- Onboarding Support – robust sandbox for streamlined testing and onboarding

- Risk Monitoring and Oversight – trusted exchange with authorized data recipients

Benefits of COR.CONNECT Hub

Access to a compliant and secure platform built for scale

Cost effective solution that reduces many-to-many data sharing costs

Standardized data sharing and UX leveraging FDX

Data privacy via consent driven solutions

Find out how Symcor can accelerate your Open Banking readiness.

Open Banking enables consumer-consented financial data to be shared with authorized third-party service providers through secure channels such as APIs (application programming interfaces).

Symcor provides a data platform that helps to accelerate Open Banking readiness and serve as a connector between Data Providers and Data Recipients.

Symcor has a proven track record for over 25 years as a trusted partner, delivering results and operating with an ideal balance of agility and security, which are critical to support an inclusive Open Banking system in Canada.